Argent in Empire Pass @ Deer Valley

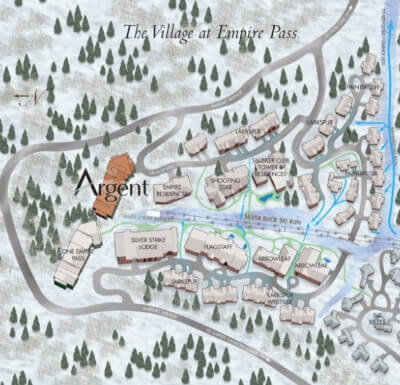

Argent at Empire Pass is a premier ski-in-ski-out location within The Village at Empire Pass area of Deer Valley Resort.

The Deer Valley real estate development known as Argent Condominiums commenced its construction in the summer of 2020. Offering direct ski access via the Silver Strike chairlift located adjacent to the building, this prime location provides residents with breathtaking views while maintaining proximity to the vibrant activities of both Deer Valley and Park City.

The residences at Argent Condominiums embody a lively atmosphere within a setting enriched with recreational and social amenities, complemented by personalized service. This development aims to create a dynamic living experience where residents can seamlessly blend the thrill of outdoor recreation with the comfort of a well-appointed home.

Amenities of Argent Luxury Condos:

The amenities curated around skiing in Deer Valley at Argent Condominiums are designed to elevate the resident experience:

Ski Valet and Private Locker: Ensuring your skiing equipment is in top condition, the ski valet service also provides a private locker for convenient storage.

Main Hall: A 2,500-square-foot ski lounge, the Main Hall serves as a communal space for residents. It offers breakfast and après-ski happy hours, creating a welcoming atmosphere to gather and unwind.

Coffee and Hot Cocoa Lounge: Residents can enjoy coffee or hot cocoa at any time in the Main Hall or opt to relax by the nearby pool.

Nook Playroom: Designed exclusively for kids, the Nook Playroom is a playland equipped with arts and crafts, video games, and board games, providing entertainment tailored for the younger residents.

Bowlski's Gaming Room: A dedicated space for entertainment, Bowlski's Gaming Room features two bowling alleys, pinball machines, and card games, offering a variety of recreational activities.

Fitness Room: Modeled after the Peloton style, the fitness room provides a Peloton-style experience with free weights and machines, allowing residents to stay in shape and maintain an active lifestyle.

Beyond these amenities, the most significant allure lies in the unparalleled access to the ski runs during winter, the convenience of walking out the door for a summer hike, and the freedom to ride a mountain bike as far as one's legs will take them. Argent Condominiums cater to an active and vibrant lifestyle, seamlessly integrating outdoor adventure with comfortable living.

Argent in Empire Pass @ Deer Valley

Argent Condominiums offer a diverse range of residences, catering to various preferences:

Two-bedroom condos with 1,627 square feet.

Five-bedroom penthouses exceeding 4,000 square feet.

The Homeowners Association (HOA) ensures a comprehensive array of services, covering:

- Concierge services

- Shuttle service

- Cable TV

- Natural gas

- Water and sewer

- Grounds maintenance

- Security

- Snow removal

- Common area taxes and insurance

Residents can anticipate breathtaking views from the property, with perspectives extending up to the Silver Strike Lift or Bald Mountain. Positioned as one of the last available development parcels in Deer Valley, Argent benefits from its strategic location. The photos showcase the remarkable long views to the north and the picturesque surroundings, including the Silver Buck Ski Run.

For those seeking a point of comparison, One Empire Pass, developed by the same developer, stands as the closest comparable to Argent Condos. This underscores the commitment to excellence and quality in both projects, ensuring residents enjoy a premier living experience in the heart of Deer Valley.

What to Know When Buying an Argent Condo in Empire Pass

Argent Condominiums are developed by East West Partners, a prominent property developer with a track record of creating ski-in-ski-out properties in Empire Pass and the broader Deer Valley Resort area. With a portfolio that reflects a commitment to delivering exceptional residences in prime locations, East West Partners is recognized for its expertise in crafting high-quality, luxury developments.

Notably, Argent Condominiums stand out as one of the few properties in Park City with LEED certification. LEED, which stands for Leadership in Energy and Environmental Design, is a globally recognized green building certification system. Achieving LEED certification underscores Argent's commitment to energy efficiency, sustainability, and environmentally friendly practices. This designation aligns with the growing emphasis on creating living spaces that prioritize both the well-being of residents and the planet.

Contact Paula Higman Real Estate - Your Local Real Estate Expert at 435.602.8228 for the best representation when buying and/or selling Argent @ DEER VALLEY.

Connect With Us:

Have a Picnic

Have a Picnic